Director / Chief Executive Officer (CEO)

Mr. Thilakeratne joined LOLC Microfinance Bank, Pakistan as the Chairman in 2024. He is currently...

The Bank received the certificate of commencement of business on 06 May 2006, effective from 08 May 2006. The Bank’s principal business is to provide microfinance services to the poor and underserved segment of society as envisaged under the Microfinance Institutions Ordinance, 2001. The registered office of the Bank is situated at, D-7 Parveen Building Shahed-e-Millat Road, Block A, Bangalore Town, Karachi. As of January 2023, the Bank has 84 branches and service centers in operation in all provinces of Pakistan, and Azad Jammu & Kashmir, and Gilgit Baltistan, including the Federal Capital Islamabad, and is licensed to operate nationwide.

The bank was officially renamed from Pak Oman Microfinance Bank to LOLC Microfinance Bank on 1 January 2023. Over time, the bank has established a prominent position in the market with 87 branches and service centres across the country. JCR-VIS has assigned the Bank a medium to long-term rating of “A-” and a short-term rating of “A-2”.

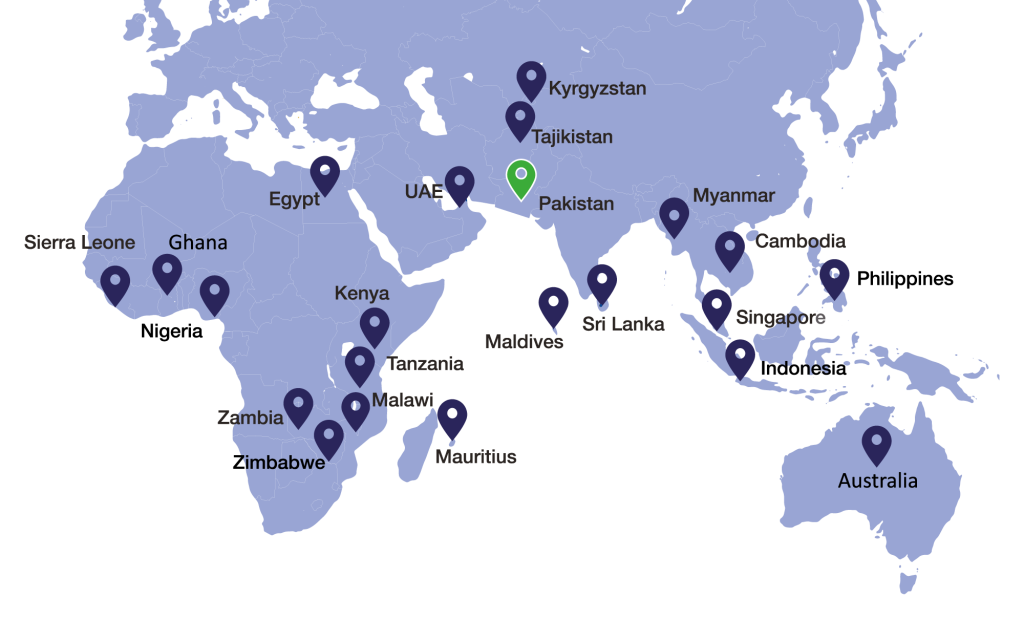

A Formidable dynamic and progressive globally diversified conglomerate, LOLC Holdings has strategically diversified into key economic growth sectors. Across every one of our broad spectra of businesses – we have always assured innovative solutions that share growth, value, and progress with our stakeholders.

As a leading player in the International MSME sector, the LOLC Group has been a catalyst in facilitating, whilst striving to maximize environmental benefits through green financing, promoting financial independence for women and uplifting customers from poverty through financial inclusion in global markets. In keeping with its alignment to UN Sustainable Development Goals, LOLC is a catalyst of economic development as a responsible lender while maintaining strong client protection principles.

Director / Chief Executive Officer (CEO)

Chief Operating Officer

Chief Recovery Officer

Non Executive Director

Non Executive Director

Non Executive Director

Independent Director

Independent Director

Chief Executive Officer

Our Team of Management are highly skilled professionals who are committed to helping you achieve your financial goals.

Chief Executive Officer

Chief Commercial Officer

Chief Financial Officer

Chief Risk Officer

Company Secretary & Head of Legal

Head of Compliance

Head of Operations

Head of Information Technology

Head of Human Resources

Head of Administration

Head – Collection & Recovery

Head of Internal Audit

Head of Security

To be a leading Micro Finance Bank of Pakistan, providing financial solutions to the poor masses for alleviation of poverty.

To create quality and sustainable income generating opportunities for the poor people of Pakistan, particularly women with a focus to bring visible change in their lives through quality and innovative micro finance services.

Our team is always at the your service and we look forward to receiving your enquiries. Please feel free to contact us using the details below or send us your email address to receive information about our products and services.

LOLC Microfinance Bank was formerly known as Pak Oman Microfinance Bank Limited (the Bank).The Bank was incorporated on 09 March 2006 as a public limited company under the Companies Ordinance, 1984 (repealed with the enactment of the Companies Act, 2017 on 30 May 2017) and was licensed by the State Bank of Pakistan (SBP) on 12 April 2006.

UAN:

021-111-115-652

Phone:

+92-21-34300381-85

Registered Office address:

Park View Plaza, Bearing 6300-Near Hotel Royal Palace, Jhelum Road, Chaklala Cantt, Rawalpindi.

The proper handling and protection of personal information is an important social responsibility. As a result, LOLC Microfinance goes above and beyond to ensure that clients’ personal information is used appropriately and protected by industry standard security methods.